Get the GuestTappy app

Scan the QR code to download the app

Why is no one talking about this?

Virtual credit cards (VCCs) are not the answer for independent hotels and B&Bs. Yet the industry seems to have settled (rather lazily) into accepting them. And while most of the discussion focuses on fees and administration, the biggest drawback is often buried too far down.

So let’s address the biggest elephant in the room first.

The most damaging impact of VCCs is the control they give Online Travel Agents (OTAs) over the final rate offered to the guest.

When an OTA collects payment, it’s entirely up to them what they charge the guest. That leaves your direct hotel rate exposed and vulnerable to being undercut. And believe me, the OTAs know exactly what they’re doing.

They tested this strategy years ago, and it’s been a huge success for them.

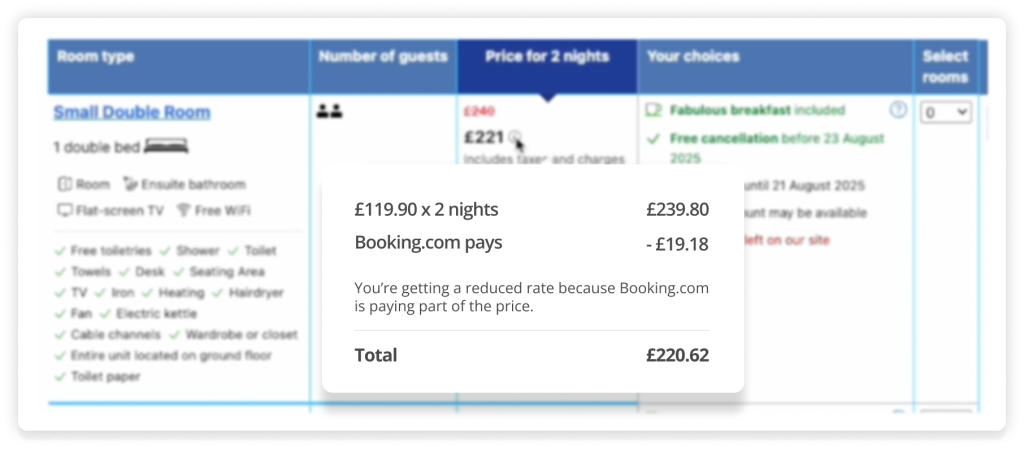

By collecting payment, OTAs can undercut your direct rate by reducing their commission. If you haven’t seen it in action, it looks something like this:

On the surface, this may look harmless. In reality, it has a massive impact on direct bookings for hotels using VCCs.

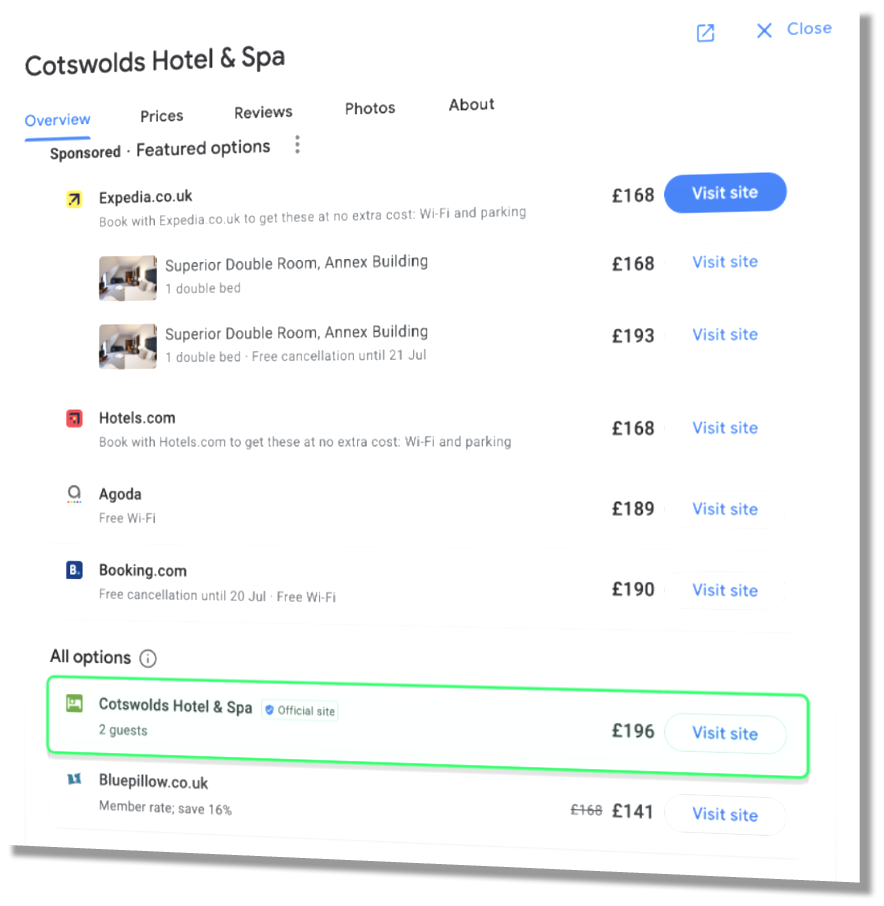

It almost guarantees the OTA the booking. When searched on Google, it often looks like this:

And this happens millions of times every single day.

The consequences?

Lost direct bookings. Lost bookings altogether (switch selling). We’re talking billions of pounds in additional booking revenue for OTAs.

A lower OTA rate drives cheap, ready-to-book traffic straight to the OTA website. A guest searches specifically for your hotel, only to find the best price is on an OTA.

The cheapest price gets the click.

Once the guest lands on the OTA website, carefully selected alternative hotels are presented, designed to guarantee the OTA secures a booking, even if it’s not yours.

Take a few minutes to search for your own hotel on Google and see how it works. You’ll often notice that the hotel listed just below yours on the OTA listing is:

This is extremely sophisticated, data-driven marketing, refined over billions of searches and bookings by machines that are constantly learning and optimising. At this point, you’re very unlikely to win the guest back.

Now take a step back.

That guest may have been recommended your hotel or may have stayed with you before. You’ve already done all the hard work. Yet a simple Google search causes you to lose them, because the VCC allows the OTA to undercut your direct rate.

And remember: OTAs also aggressively bid on hotel brand names in paid search, further reducing the chance of guests booking direct (but that’s a blog for another day).

Despite this, the use of VCCs has grown significantly over the last five years, and that growth shows no sign of slowing.

Why?

Because OTAs are pushing them very hard.

Quite simply, VCCs make them a lot of money.

OTAs earn a substantial rebate or share of the card or transaction fee every time a hotel processes a VCC. Just in case this isn’t widely known: VCCs are usually the most expensive cards a hotel can charge; often 1-2 times more expensive than taking payment directly from the guest.

For example, if a UK guest pays the OTA via their debit card, it typically costs the OTA around 0.5% in card charges. When the hotel later takes payment via the VCC, the cost is usually at least 2.5% often rising to 3.5%.

That’s a significant additional cost per booking, especially when most UK hotels could take payment directly from guests for well under 1% (in the UK). The margin here is substantial, benefiting both OTAs and card networks such as Visa and MasterCard.

Some payment providers even advertise that they “pass a lucrative share of the card fees on these VCCs to their OTA clients so they recognise financial gains from their B2B card program”.

VCCs also dramatically improve the OTA’s cash flow.

For non-refundable bookings, the OTA takes payment immediately. The hotel, however, can only access that money at check-in or check-out. That means billions of pounds sitting in OTA bank accounts, providing working capital, funding marketing activity, or simply earning interest.

The reverse is true for the hotel: reduced cash flow.

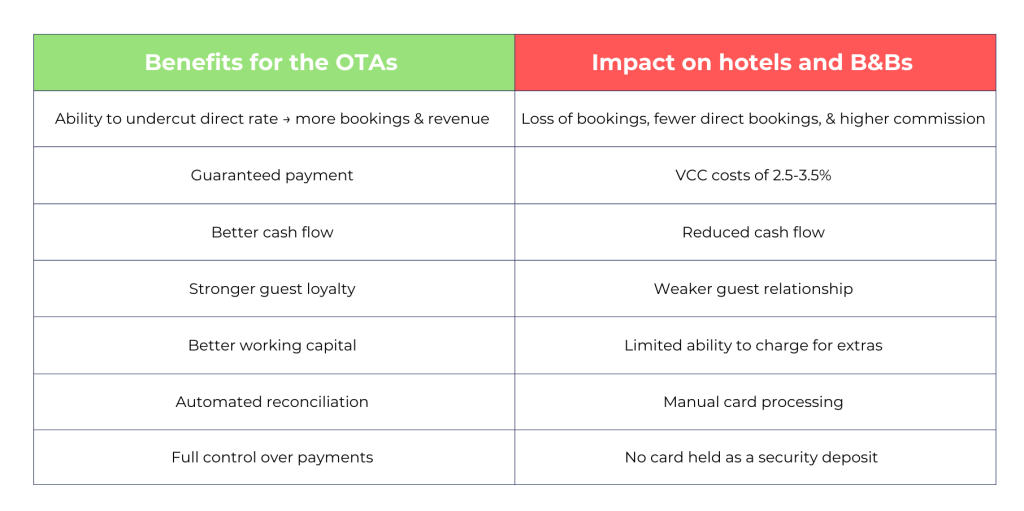

Other advantages for OTAs include:

That’s a long list of benefits for the OTAs, which explains why they promote VCCs so heavily, and why they often use subtle scare tactics to encourage hotels to adopt them. Some hotels even tell us they never opted in yet find themselves using VCCs anyway.

What’s clear is that OTAs are extremely good at persuading hotels to do what works best for the OTAs. They are marketers, after all.

To be fair, there are situations where VCCs can make sense, particularly for small independent accommodations that don’t have access to reliable online payment services or alternative payment mechanisms. This is often dependent on geography.

However, to suggest that VCCs are a panacea for payments is simply wrong.

Below is a simple comparison to help you decide whether VCCs truly work for your hotel.

There are a lot of elephants in the room, and they’re munching away at your revenue!

On a serious note, this has cost independent accommodation providers billions in lost booking revenue over the years.

So why is nobody talking about this?

An entire ecosystem benefits financially from VCCs: OTAs, card networks (Visa and Mastercard), and payment providers. Naturally, these organisations focus only on the positives.

What is surprising is that even some booking engines and PMS providers recommend VCCs, despite the clear disadvantages outlined above.

It’s hard to see a genuine upside for VCCs. More concerning is the fact that they give OTAs a powerful tool to undercut hotels and B&Bs’ direct rates.

Many businesses remain blissfully unaware that the true cost of VCCs is far more than card fees; it’s the loss of control over payments, pricing, and ultimately the guest relationship.

Scan the QR code to download the app